What’s next after your loan is approved? Read the disbursement letter thoroughly, because the money comes to you in phases, not all at once. It’s better to be prepared than stranded in a foreign country with no money in hand and putting your dreams on hold.

The education loan disbursement letter is an important document that explains how much of your loan amount will be released for each semester and when. It also mentions who will receive the funds, such as your university or you. Missing these details can delay tuition payments, affect your visa, or disrupt your travel plans.

In this blog, you’ll discover what this letter is, why it matters, and how to handle it with confidence. Whether you’re a student preparing for your dream college or a parent supporting your child, we’ll make this process clear and easy.

In simple words, it’s your lender saying: “Your loan is ready. Here’s how we’ll send the money.”

This letter gives you, your university, and even the embassy, confidence that funds are in place.

What Does the Disbursement Letter Include?

The disbursement letter clearly outlines all essential details of the education loan. It serves as a concise summary of the approved loan amount, disbursement terms, and how the funds will be allocated.

A typical education loan disbursement letter includes:

Each point in the letter serves a purpose. For example, universities abroad often use this to confirm that your tuition fees are covered.

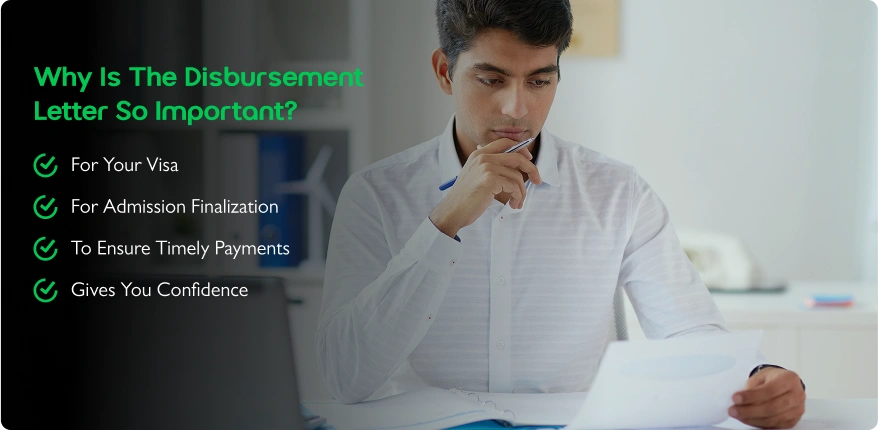

This letter plays a critical role beyond being a formal document. It serves as official confirmation that your education is financially secured and that necessary funds are in place for your academic journey.

Embassies ask for this letter to confirm that you can pay for your education. It’s a key document during the visa process.

The university needs to know that tuition fees will be paid. This letter tells them your lender is ready to release the money.

For students and parents, the letter is written proof that funds are in place and will be sent on time.

The disbursement letter comes after your loan is approved and all documents are signed. It’s one of the last steps before the actual money is released.

Banks may give you a printed letter. NBFCs usually send digital copies via email or through online portals. Either way, it’s official and accepted by universities and embassies.

Quick tip: If you need your visa soon, let your bank or NBFC know. This will help them issue the letter faster.

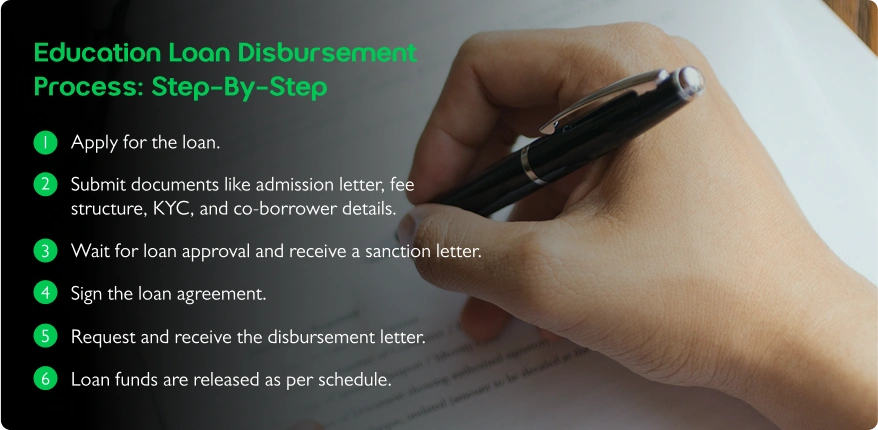

If the education loan disbursement process seems confusing, here’s a quick and simple look at how the process works to get your loan disbursement letter and receive the funds:

Each step takes time and care. That’s why Qck Loans is here to help from start to finish.

We understand that paperwork can feel overwhelming, especially when deadlines are close. At Qck Loans, we step in as your guide.

With us, there’s no guesswork. Just a clear, smooth path.

Even minor errors can cause significant delays in your education loan process. It’s important to pay close attention to the details to avoid unnecessary setbacks. Below are some common mistakes that can be easily prevented.

Double-check everything and stay ahead of deadlines.

It’s common to confuse the sanction letter with the disbursement letter, but they serve very different purposes. To make it easier, here’s a simple side-by-side comparison:

The student loan process is full of unfamiliar terms, and the disbursement letter is one of them. Many students delay or mess up their next steps because they don’t understand this letter.

This delay can cost you your visa, your university spot, or even the chance to study abroad this year. That’s a heavy price to pay for one missed document.

So, don’t let a small paper delay your big dreams. Let’s get it done, together.