Study Loan for Australia

Get accustomed to the benefits, cost and opportunities

to study in Australia

Share this Article

Table of contents

Australia is a major study destination for those who want to pursue studies abroad. Several Australian colleges accept Indian students and let them pursue their preferred courses. The country holds the third-most-preferred academic destination for international students after the US and the UK. The world-class education system, academic excellence, friendly locals, and cultural diversity are some factors that attract students to Australia. This is why the influx of students in Australian colleges keeps increasing. However, the real challenge comes when arranging finances. Studying in Australia can be expensive. But do not worry; apply for a study loan for Australia, and when you get the loan, you are all set!

Types of Study Loan for Australia

Education loans are mainly of 2 types: secured and unsecured. Let’s get familiar with study loans for Australia:

- Secured Loans

A secured study loan for Australia is a student loan without collateral, and you to provide an asset as part of the loan application. The security can include assets like fixed deposits, property, insurance policies, and other precious valuables.

- Unsecured Loans

An unsecured loan is a type of loan in which you do not need to provide any asset as collateral. It is a study loan for Australia with high interest rates because of high risk. Furthermore, they need a co-applicant or co-signer, and the loan amount is ascertained depending on the co-borrower’s income and credit score.

Choosing a loan can be hassle But we make it simpler

Expenses to be Covered Under Study Loan for Australia

The costs that education loans for Australia cover are as follows:

- Tuition charges

- Costs of transportation

- Caution deposit money

- Accommodation expenses

- Cost of books, laptops, study materials, supplies, stationaries, etc

- Utility bills

- Food and groceries

- Educational tours and project work during the academic session

- Other expenses that would help you to complete your course

- Costs of leisure activities

Programs Covered under a Study Loan for Australia

The courses that an education loan for Australia covers are listed below:

- Bachelor’s Courses

- Masters Courses

- Doctorate Programs

- Diploma Degrees

- Vocational Degrees

- Skill Development Courses

Eligibility Criteria for Study Loan for Australia

Whether you secure admission for a master’s degree, bachelor’s program, or doctoral and post-doctoral courses, you need to meet eligibility requirements. It is important to meet the eligibility criteria to ensure the smooth completion of the loan application process. The prerequisites for a study loan for Australia are as follows:

- Your age should be 18 years or above.

- You must be a citizen of India,

- You should have a letter of acceptance from a recognised Australian university.

- You must have an excellent academic record.

- You should be a strong prospect for secured and unsecured loans.

Documents Needed for Study Loan for Australia

Below is the list of documents you need to submit to secure an education loan to pursue your studies in Australia:

- Admission letter from a prestigious Australian college

- Accurately filled in student loan application form

- Fee structure from your institution

- Proof of Identity: Passport/ Driving License/ Voter ID/ Aadhaar Card

- Proof of Residential Address: Utility bills/ Aadhaar Card/ Ration Card/ Passport

- The main applicant’s PAN details

- Bank account statements of the student/co-signer/ parent

- Proof of income of the student/co-signer/ parent

- Statement of assets of the student/co-signer/ parent

How to Apply for a Study Loan for Australia

Below are the steps to apply for a student loan for Australia

- Use our eligibility checker tool to avail of a study loan for Australia.

- Contact a loan counsellor and discuss your needs and preferences. The loan expert will guide you to further steps.

- Go to your chosen loan provider’s website and fill out the loan application form. Attach the relevant documents.

- Submit your application and wait for verification, which usually takes 7 to 10 working days.

- When the bank approves your application after thorough verification, sign the agreement letter and keep checking your application’s progress.

- The loan disbursement process will begin as per the rules and regulations of the lender. The loan amount will either be deposited into your account or to the university’s account.

Repayment Terms of a Study Loan for Australia

When securing a study loan to pursue studies in Australia, considering the repayment terms is crucial. The repayment tenure and options for the grace period are important to consider when selecting a lender. Multiple repayment options are available like simple interest, partial simple interest, and EMIs. To help you make an informed choice regarding your study loan for Australia, the table below outlines the repayment tenure and options offered by different loan providers:

| Name of Loan Provider | Repayment Tenure |

|---|---|

| HDFC Credila | Up to 15 Years |

| Avanse Financial Services | Up to 15 Years |

| ICICI Bank | Up to 10 Years |

| Incred | Up to 15 Years |

| Prodigy Finance | Up to 15 Years |

| MPOWER Financing | Up to 15 Years |

| Auxilo Finance | Up to 15 Years |

| SBI | Up to 15 years |

| UBI | Up to 15 years |

| Axis Bank | Up to 15 Years |

| IDFC FIRST Bank | Up to 12 years |

Factors to Consider When Choosing a Lender for a Study Loan for Australia

You already know the types of education loans, the eligibility criteria, the paperwork, the application process, the expenses covered, and the repayment tenure. Now, the biggest question that arises here is how to choose a lender among so many loan providers. You think so too, don’t you? Don’t worry; here is the answer. Before applying for a study loan for Australia. All you need to do is compare the lenders based on the following pointers, and you will get your answer:

- Interest Rates

- Processing Time and Fees

- Margin Money

- Grace Period

- Tax Benefits

- Repayment Tenure and Terms

- Loan Tenure

- Costs of Education Covered

- Prepayment Terms and Conditions

Post Study Work Opportunities in Australia

- Australia offers strong post-study work opportunities for international graduates.

- Students can apply for the Temporary Graduate Visa (subclass 485).

- This visa allows graduates to stay and work for 2 to 6 years, based on qualification and location.

- It provides valuable work experience and boosts career growth.

- Graduates in IT, engineering, healthcare, and education are in high demand.

- Post-study work can improve chances of permanent residency.

- Australia’s stable economy and supportive visa policies make it a top destination.

- Work rights are clearly defined, ensuring a smooth transition to employment.

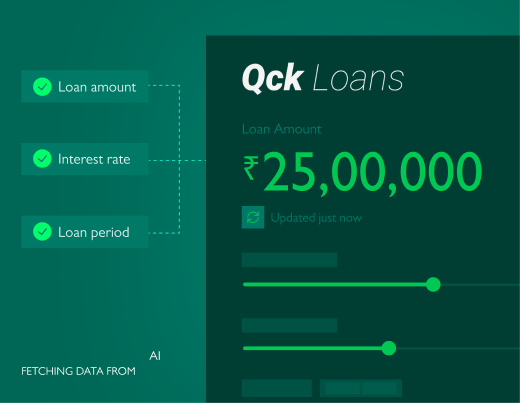

Our free tools will help you out

Our advanced tools, such as the EMI calculator and loan eligibility checker, streamline the process of obtaining quick student loans for studying abroad by eliminating complex procedures.

EMI Calculator

Determine your EMIs and repayment schedules before committing to a student loan.

EMI Calculator

Determine your EMIs and repayment schedules before committing to a student loan.

Everything you need to know

Yes, you can. The maximum loan amount you can get without collateral is approximately Rs. 40 to Rs.50 lakhs based on the lender.

A loan provider can take somewhere around 10 to 15 days to process your loan application.

Some loan providers do offer a concession on the interest rates they charge for female applicants.